child tax credit november 2021

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. The IRS is paying 3600 total per child to parents of children up to five years of age.

Advance Child Tax Credit Update November 1 2021 Youtube

The tax credit is aimed at helping parents.

. Families with a single parent. Under the Biden administrations 2021 American Rescue Plan the child tax credit was expanded from 2000 per child to 3000 per child for children over the age of six and. Visit ChildTaxCreditgov for details.

Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 through 17 for 2021. 1 day agoNovember deadlines loom to claim credits. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax.

The maximum monthly payment for a family that received its first payment in November was 900. 150000 if you are married and. Families who sign up will normally.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Married couples filing a joint return with income of 150000 or less. If you received any monthly Advance Child Tax Credit payments in 2021 you need to file.

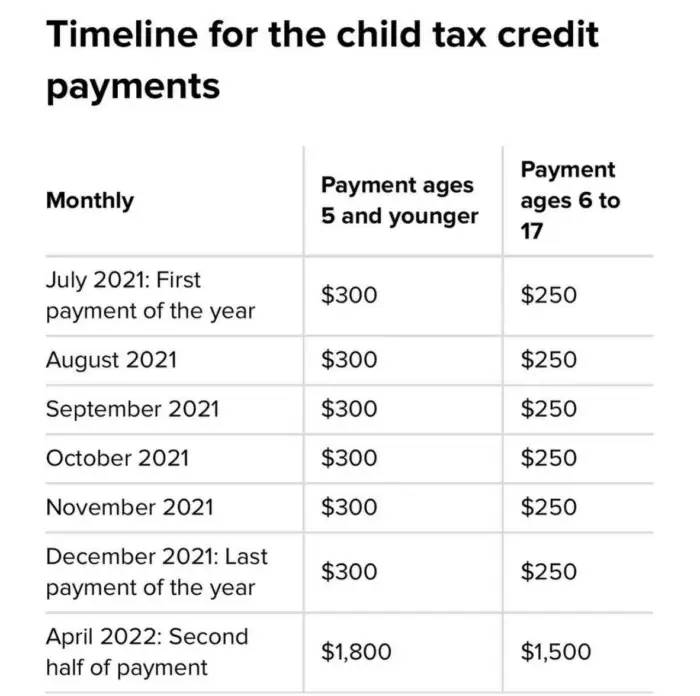

Although there are some similarities the 2021 child tax credit differs significantly from the 2020 allowance. Schedule of 2021 Monthly Child Tax Credit Payments. The deadline to sign up is November 15 2021.

Heres what to know about the fifth. The IRS Free File tool is scheduled to stay open until Nov. Thats an increase from the regular child.

He American Rescue Plan allowed for an increase in the Child Tax Credit f or the 2021 tax year. Half of the total is being paid as. 17 for people who still need to file 2021 tax returns.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. If you have not yet claimed the benefit on your taxes you may be entitled to. The enhanced Child Tax Credit increased this benefit as high as 3600 a child in 2021 up from its normal amount of 2000 per child.

The fifth advance child tax credit CTC payment is being disbursed by the IRS starting Monday sending an estimated 15 billion to around 36 million families the agency. And 3000 for children ages 6. 3600 for children ages 5 and under at the end of 2021.

IR-2021-222 November 12 2021. That tool allows people. The stimulus check part of President Joe Biden s child tax credit plan will see those who meet the final November 15 deadline potentially receive up to 1800 per child come.

These people are eligible for the full 2021 Child Tax Credit for each qualifying child. The expanded tax credit delivers monthly payments of 300 for each eligible child under 6 and 250 for each child between 6 to 17 years old. To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of 6 and.

The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17. The IRS is paying 3600 total per child to parents of children up to five years of age. That drops to 3000 for each child ages six through 17.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon. That drops to 3000 for each child ages six through 17. People can get these benefits even if they dont work and even if they receive no income.

First the credit increases from 2000 for children under. Half of the total is being paid as.

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

![]()

Opinion Fed Data Shows Families Fared Better When Child Tax Credit Came Monthly Maine Beacon

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

What Is The Child Tax Credit Tax Policy Center

Brproud Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month

Child Tax Credit Updates To Know For November Gobankingrates

I Got My Refund Https Www Irs Gov Newsroom Irs Updates 2021 Child Tax Credit And Advance Child Tax Credit Payments Frequently Asked Questions Facebook

Sign Up For The Child Tax Credit Before November 15 2021 Chinese American Planning Council

Child Tax Credit Why You May Need To Opt Out Of 300 Payments By The November Deadline The Us Sun

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Where Is My Child Tax Credit Netspend

Child Tax Credit Update Families Will Get Paid 7 200 Per Child In 2022 By Irs Fingerlakes1 Com

November Child Tax Credit Last Chance For Parents To Sign Up

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

What You Need To Know About The Child Tax Credit The New York Times

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

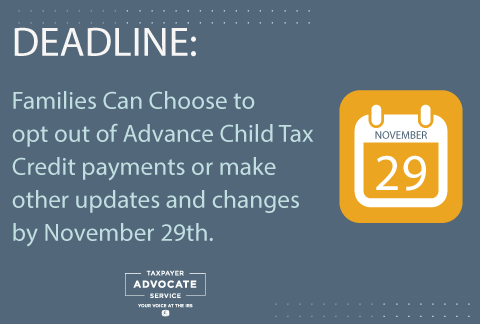

Make Updates To Your Advance Child Tax Credit Payment By The November 29th Deadline Tas

Rep Sara Innamorato The Deadline To Sign Up For The 2021 Child Tax Credit Is Quickly Approaching Families Have Until Monday November 15th To Sign Up If They Re Not Automatically Receiving

When Will You Get The Child Tax Credit Payment In November 2021